Cyril Widdershoven: Senior Fellow at the Mediterranean Institute for Regional Studies.

Geopolitical disruptive thinker, focused on Commodities, Geopolitics, MENA and Security. Assessing investments, FDI, SWFs, Key-Stakeholders and power players in MENA, EastMed and Central Asia.

The ongoing energy crunch, as mentioned in the media, hitting the EU soon, is going to change possible narratives in Brussels and the respective European capitals. Possible natural gas and energy shortages hitting European customers and industry the coming months is putting extreme pressure already on respective governments. Due to higher energy costs, showing a possible record price level of $100 MBTU or $250 per crude oil barrel equivalent is putting fear in the eyes of politicians, especially in the Netherlands, Germany, France and the UK. Politicians in NW-Europe are facing possible societal unrest if nothing is being done to change possible extremely high energy bills for lower income groups. At the same time, industry is calling upon governments to assist to prevent possible further shutdowns of critical production, such as fertilizers, steel and aluminum or even all-out chemicals.

In a possible dramatic shift with former energy transition goals and political strategies, the Dutch government at present is considering the re-opening of the Groningen gas field, the former largest onshore European natural gas field, known to be the only short-term option available. As the natural gas shortages, mainly still when looking at overall gas storage levels and buffers, is increasing, some politicians in the Netherlands start to question the decision to close down the natural gas production of the latter Dutch field. The Groningen field not only supplied natural gas (low caloric) to Dutch customers and industry, but also was one of the main suppliers to Germany, Belgium, north of France and even as supplier of last resource to the UK. By removing the pivotal supply to the European markets the Dutch decision is part, or maybe the main, reason for the current situation. The last decades, Groningen always was able to supply additional volumes in case of shortages or emergencies (Russia-Ukraine disputes). Even that part of the Dutch society and opinion will not be supportive, the current Dutch government is reconsidering a possible re-opening of the field to take some of the pressure out of the market.

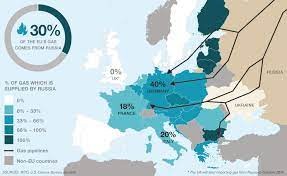

At the same time, European leaders are in dire need to reconsider their diffuse position towards Russian gas supplies and the future role of NordStream 2, the new Russian-German gas pipeline addition, which is still being discussed and threatened by US sanctions and Eastern European opposition. It seems that Russia’s leader Vladimir Putin however is holding the best deck of cards, as without additional and substantially more natural gas supplies to Europe, consumers and industry should be preparing for a possible cold winter. Europe’s gas supply diversification has been a major disaster, not only due to inherent EU tactics and regulations, but also because of the ongoing one-sided emphasis on energy transition, hydrocarbon divestment and full-scale investments in renewables, without realizing that the backbone of the European economic system is still hydrocarbon linked.

The current situation shows one main fact of life, the success of the energy transition is not based on a one-sided approach, putting all eggs in one basket, while killing the other goose with the golden eggs. By reshaping the European energy markets, opening up and liberalizing the total system, market fundamentals have been introduced, which were working very well in a hydrocarbon organized system. The end of oilprice-indexed long-term gas contracts was hailed by most as a breakthrough. Putin however now is hitting back by showing that a spot-market is not always the best option.

By introducing new renewable options, the market got destabilized, but politicians and others didn’t want to admit the latter. Destabilization could and should be prevented, by acknowledging the fact that for the foreseeable future hydrocarbons, including coal, will be playing a major or even overwhelming role in the energy sector of the continent. At the same time, European politicians also should acknowledge that without hydrocarbons not only energy supply is being threatened, as renewables need to be backed up, but also the hydrocarbon economy is being hit substantially. Not yet fully understood by most, but without hydrocarbons, especially natural gas and oil, food and other primary sectors are being hit. The first shutdowns of fertilizer and steel companies have already been reported.

Looking at the current dire situation, which is not only linked to higher energy prices, which have been in place before during the last decades, but also to total economic strength of the EU, new realism is needed in Brussels and others European capitals. Believing a dream about renewables, Green Deal or Net-Zero, is positive and should be supported. Realism also however should not be thrown out of the window, as hydrocarbons are still the main power in all. By being confronted by a energy shortage or energy poverty situation, politicians and companies are risking to loose the still fledging support of the majority of European voters very soon. We all think with our heads and hearts, but vote with our wallets.

Brussels, London, Berlin and even The Hague, should start to change their approach to energy and the economy of the future. Politicians should start to listen to market analysts and geopolitical thinkers, that have been warning for the tectonic shifts being put in place, without realizing that this could lead to a major earthquake or tsunami. By opening up the energy markets the last decades, removing and believing in the power of the global energy market without realizing that hydrocarbon/energy and geopolitics are sleeping in the same bed, risks have been taken that are now hitting us in the face. When proposing a liberal energy market, which I am a supporter off, Brussels also should have been allowing that market parties would be able to source additional energy by all means. Europe’s regulations however have prohibited companies to work together as a group to be able to reach long-term or large-scale new gas deals with new non-Russian producers. The last years, when a global gas glut was hitting the market, deals could and should have been made with Egypt, Qatar, and other players, not only linking new supply but also bringing stability.

At the same time, a clear strategy should have been shown indicating that while setting up a Green Deal and forcing energy transition, a hydrocarbon backbone should be in place, including investments in storage and new supply deals. Without the latter, supply giants such as Putin’s Russia is holding all the cards. The coming months new research and assessments should be made how to deal with this situation, not prohibiting any options from the start. Deals need to be made with new suppliers, and even a new energy cooperation approach with Putin should be put in place. Realizing that Russia is and will be the main oil and gas supplier of the European continent is maybe hard to swallow for most European politicians and renewable proponents, but a fact is a fact.

Taking the current approach of Brussels, as shown by EU Commissioner Frans Timmermans, the gap between strategies and reality is going to be widened. Threatening higher price levels without giving any option to counter energy poverty or lower welfare levels is not going to reap the fruits that Brussels is aiming for. Brussels and most European governments should be watching out that higher energy prices or shortages of consumer-products will not lead to unrest on the street. Energy transition means a slow progress over a long period of time. Brussels, The Hague, Berlin and others, however seem to be thinking that energy transition is an energy revolution, without blood on the streets. This winter could be wake-up call for most, especially voters. The Dutch government’s discussion at present to assess a re-opening of Groningen should be a clear warning sign to others. The Hague is taking a big risk by even stating this in the media, as a large group of people in Groningen will be not very happy, to say the least. For the rest of Europe, fear and anger could be even worse. Without any doubt, the discussion on energy transition and strategies will be heating up. Hopefully, this time politicians will be leaving their glass bowls and have a talk with all parties involved, including the battered oil and gas sector players. To rely on the market means also to support market players, if they don't exist or are forced to shed part of the supply options, no solutions are more available. Except maybe National Oil and Gas Companies such as Gazprom, Rossneft, Qatar Petroleum or EGPC Egypt.